income tax malaysia login

You can get your income tax number by registering as a taxpayer on e-Daftar and you can get your PIN after that either online or by visiting a LHDN branch. Taxpayers can make payments of income tax and real property gains tax using a credit card online at httpsbyrhasilhasilgovmycreditcard These services can be used for all.

Solved Assignment 2 Inflations This Is Individual Chegg Com

Resident individuals are taxed based on a progressive tax rate from 0 to 30 on chargeable income while non-resident individuals are based on a flat rate of 30.

. Login to MyTax Once you have your new PIN navigate to the new MyTax website and login using the First Time Login option. To make it easier for tax payers to fill and file Income Tax Return Form ITRF To speed up on processing of Income Tax. Then select option e-Daftar from Favourite Services.

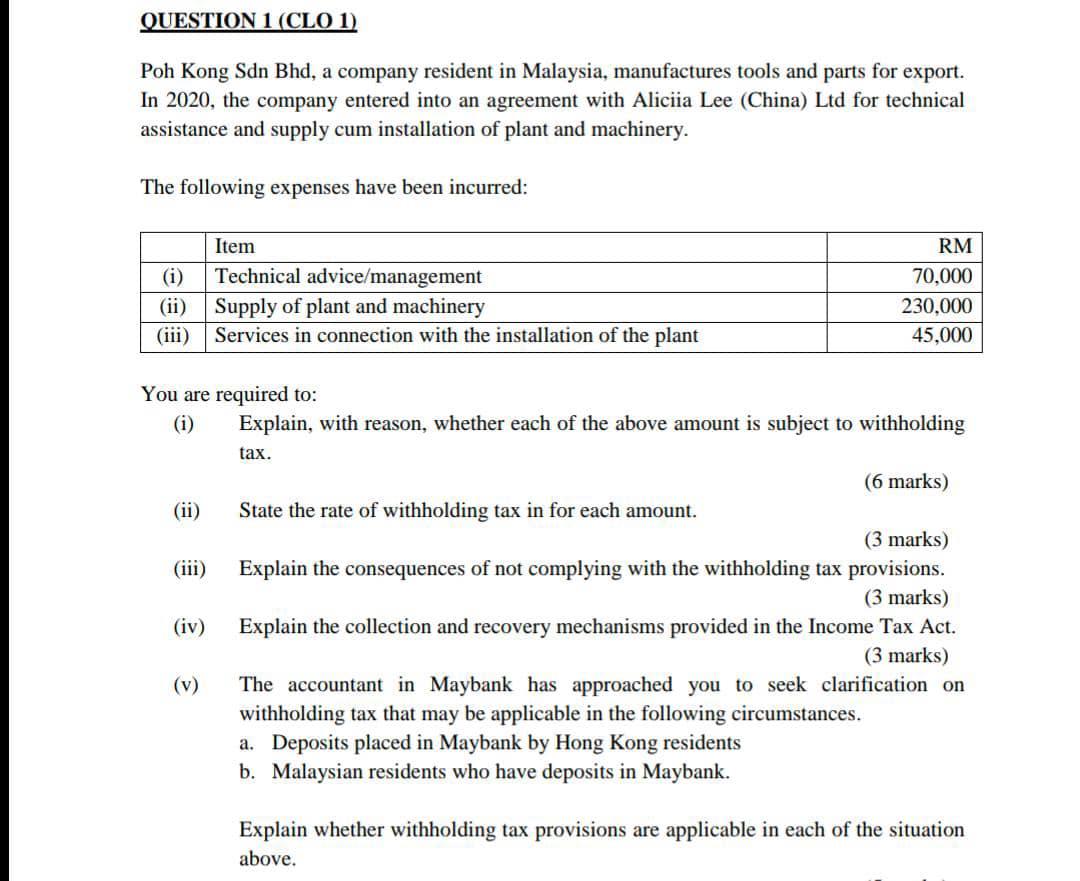

Then select Daftar Individu. Also please note that the e-TT system is currently not applicable for withholding tax payments under Sections 107D and 109DA of the Income Tax Act 1967. Under e-BE select the Year of Assessment.

Personal Income Tax Number. The e-TT system and the user. To get your income tax number youll need to first register as a taxpayer on e-Daftar.

1 Pay income tax via FPX Services The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. C Dividends interest or discounts.

Excellent Job by IncomeTaxIndia. Tax is imposed annually on individuals who receive income in respect of. A Gains profit from a business.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. B Gains profit from employment. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. Check out our step. Once youve logged in click on e-Form under e-Filing.

Fill in all the information required to facilitate the process of calculating your total income tax. Thanks to everyone who were involved in the process. The objectives of e-filing service are as follows.

Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut. Confirm your particulars on the next page and click. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

You will then be asked to create a new password. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. First of all you need an Internet banking.

Visit website After you get the Pin Number visit to httpsezhasilgovmyCI Click Login Kali. Received refund in my account today. Heres a more detailed.

Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors. Deadline for Malaysia Income Tax Submission in. Finally you need to confirm the assessment form and then send it to LHDN online.

You will get the application result around 7 working days after the application 5. Select MyTax from the menu. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

You can do this online at wwwhasilgovmy. 199101015438 225750-T B-13-2 Megan Avenue 2 No12 Jalan Yap Kwan Seng 50450 Kuala Lumpur Malaysia Tel. After that you can obtain your PIN online or by visiting a LHDN branch.

Chartered Tax Institute of Malaysia Registration Number. Filed a tax audit report along with IT return.

How To File Your Income Tax In Malaysia 2022 Ver

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Never Filed Income Tax Before Here S A Simple Guide On How To Do It Online World

Malaysia Personal Income Tax Guide 2020 Ya 2019

9 Income Tax Ideas Income Tax Income Tax

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Guide To Using Lhdn E Filing To File Your Income Tax

Yc Accounting And Personal Tax Services Want To Know More About Personal Income Tax In Malaysia Fresh Grad With Your First Job Working Adult But Still Doesn T Know How Income

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

How To File For Income Tax Online Auto Calculate For You

How To File For Income Tax Online Auto Calculate For You

Income Tax Malaysia 2022 The Complete Income Tax Guide 2022

0 Response to "income tax malaysia login"

Post a Comment